MLP Investing in the Downturn

“Q&A” With Dr. Brian Chen, Chief Investment Officer & Portfolio Manager, Liberty Cove Investors.

Q - What is your position on the MLP sector in light of the recent, severe market volatility we have experienced?

A - We’re keeping a long-term perspective and we remain confident in the ability of MLPs to provide attractive yields and long-term capital appreciation. It’s important during times like these to avoid trying to “shut the barn doors after the horses have already left.” Markets have already responded pretty sharply to the Coronavirus Covid-19 shock as well as the OPEC+ squabbles. Although markets may not be perfectly efficient all the time, it’s pretty hard to believe that market participants aren’t aware of these two news events, so it seems pretty likely that market prices have already been discounted to reflect them. With so many people focused on recent negative shocks, it’s important to remember that, going forward, surprises can occur on the upside as well as the downside. That might be, for example, why we’ve seen the management teams of so many midstream energy companies utilizing the downturn as a buying opportunity, with significant insider buying occurring, even after the recent oil price declines. These folks have skin in the game

In the longer term, once the economy begins to recover from the Corona virus shock, the demand for energy could recover sharply. That would immediately improve throughput in energy pipelines and storage facilities, providing a catalyst for the MLP sector. In such an environment, we believe MLPs will continue to be able to provide attractive yield spreads over other income investments, given MLPs’ structural tax advantages and toll road business models.

Q - The yields on the MLP indexes seems unusually and unsustainably high. What should investors expect to receive?

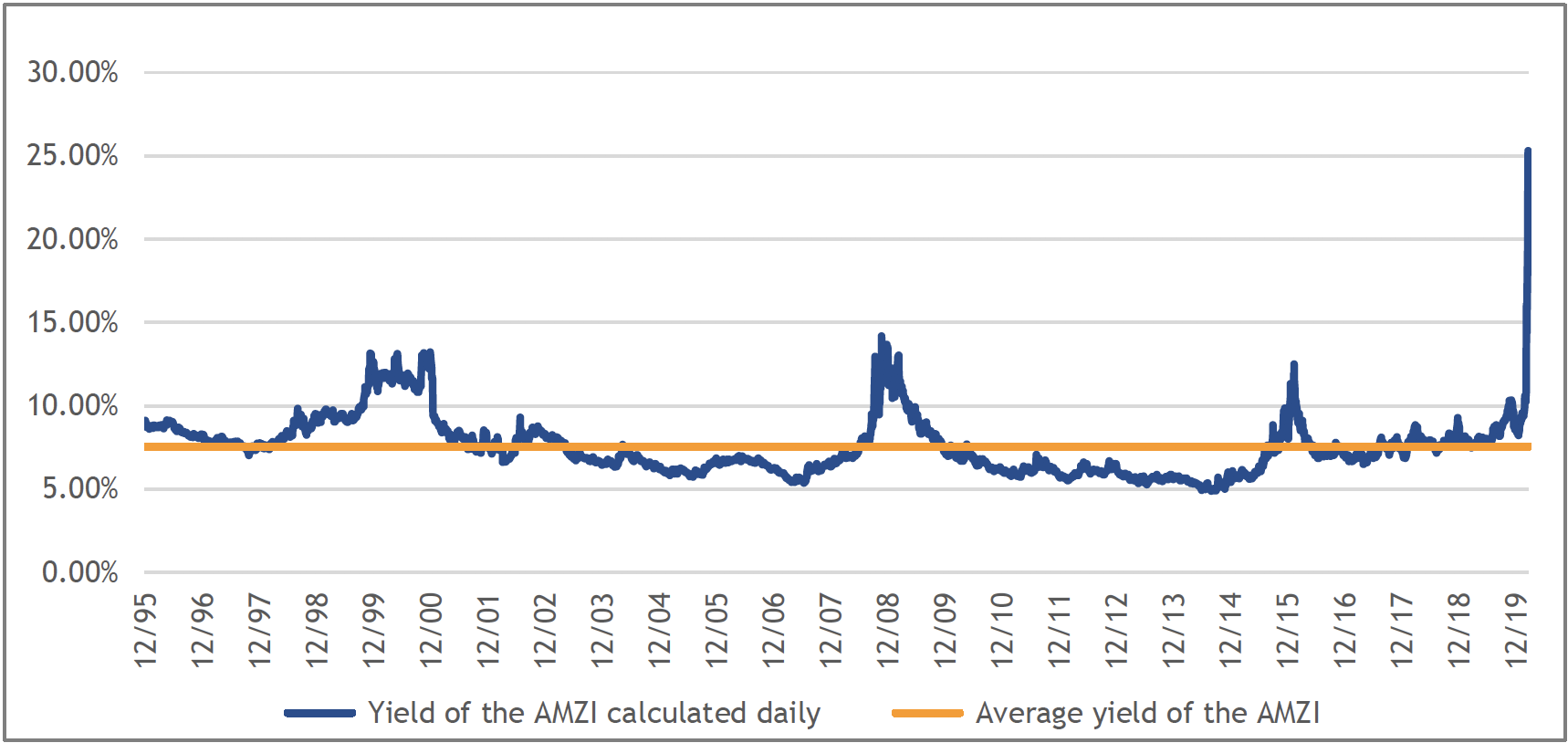

A - As of March 20, 2020, the yield on the Alerian MLP Infrastructure Index was nearly 20%, as compared with a long-term average of 7.5% from inception to January 2020.

Many market observers expect MLPs to reduce their distributions – reducing their dividend yields – in order to retain cash for other purposes, including debt repayment and other financial and capital obligations. A recent analysis by Alerian showed that even if every index constituent cut its distribution by 50%, an extreme assumption, the resulting yield of 9% would still remain above comparable yields for utility stocks and REITS, and in-line with the pre-crisis MLP yield level1. Again, that’s just another indicator of how deeply markets have already priced in recent news. Additional analysis by Alerian shows that on average, contracted fee-based revenues account for 82% of MLP cash-flow, providing a solid source of support for continued healthy distributions.2

Yield of the Alerian MLP Infrastructure Index (AMZI), 12/31/95–3/20/20

1 Alerian, Midstream MLPs: Examining AMZI Constituent Debt Profiles and Index Yield Scenario Analyses. https://tinyurl.com/sfddljh

2 Alerian, Insights at a Glance: Highlighting MLP/Midstream’s Fee-Based Exposure in Today’s Tough Tape. https://tinyurl.com/vx5z332

Q - What were the drivers of the downturn for MLPs? Why is the downturn so much more pronounced than for the overall market?

A - For MLPs and energy more broadly, it’s been a toxic combination of the fallout from the “oil war” between Saudi Arabia and Russia, oversupply of oil & gas due to the fracking boom in the US and the economic downturn caused by the global policy response to the corona virus. The downturn in MLP values was also likely exacerbated by the deleveraging of some high-profile leveraged closed-end MLP and energy income funds. Note that we do not use leverage in our trueMLP approach.

Q - How has the trueMLP strategy been doing?

A - The strategy has certainly been stress-tested – to an extreme – with everything going on in the sector and the overall market! We’ve been very pleased that, throughout all of this unprecedented stress, our strategy has delivered as promised; it has tracked the MLP benchmarks very faithfully. We are gratified that our portfolio management process, trading counterparties, fund administrator and all other operational aspects of the portfolio process have held up robustly during this period of unprecedented volatility.

Q - There has been speculation about the continued viability of the MLP structure. What do you see for MLPs going forward?

A - In spite of the volatility in the energy sector and the conversion of some MLPs to C-Corporations in recent years, the fact remains that the MLP structure can provide unique benefits to firms that employ it, and for investors seeking yield and potential tax advantages. As economic uncertainty diminishes and volatility subsides – which has been the pattern in the past – we expect the outlook for energy demand to improve, bringing stabilization and renewed interest in the sector. For investors seeking access to MLPs, we believe an approach such as trueMLP, which offers up to 100% exposure to MLPs while maintaining registered investment company status for tax purposes, can be an attractive option for investors seeking current income and long-term capital appreciation.

Brian Chen, PhD.

Chief Investment Officer

Portfolio Manager

Liberty Cove Investors

Brian serves as the Chief Investment Officer and Portfolio Manager for Liberty Cove’s investment strategies. Before founding Liberty Cove, he was a Portfolio Manager at North Peak Asset Management and, prior to that, the lead quantitative analyst for Absolute Investment Advisers’ (AIA) $4.5b Absolute Strategies Fund and the Head of Research for Bay Hill Capital Management.

Brian’s experience in quantitative trading strategies includes stand-alone, single strategies and multi-strategy, multi-manager portfolios. He has built global macro, commodities, tactical asset allocation, and volatility arbitrage strategies employing futures, ETFs, options, and other derivatives.

Earlier in his career, Brian co-founded and served as Chief Scientist and Vice President of Technology of Chinook Communications, a venture-financed, technology company developing sophisticated signal processing technologies. He has also been a Member of Technical Staff—Level 1 and Consultant for Lucent Technologies Bell Laboratories.

Brian was awarded the Ph.D. degree in Electrical Engineering and Computer Science, with a concentration in Signal Processing, and a minor in Finance, from the Massachusetts Institute of Technology (MIT). In addition, he holds a S.M. degree in Electrical Engineering from MIT, and the B.S.E. degree (summa cum laude) in Electrical Engineering from the University of Michigan.

Brian is an inventor on 14 issued patents and has received the National Defense Science and Engineering Graduate Fellowship.

Disclosure: The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or to participate in any trading strategy, nor do the opinions expressed represent financial or investment advice. Opinions expressed in this document are subject to change without notice and do not represent a guarantee. If any offer of securities is made, it will be pursuant to a definitive offering memorandum prepared by Liberty Cove that contains material information not contained herein and which supersedes this information in its entirety. Any decision to invest in the strategy or fund managed by Liberty Cove should be made after reviewing such definitive offering memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. An investment in Liberty Cove’s strategy involves significant risks, including loss of the entire investment.