A Closer Look at Oil Prices and MLPs

By Mathew Jensen, CFA, Portfolio Manager, and Anthony Wang, Quantitative Research Analyst, Liberty Cove Investors

As carriers of “black gold”, along with other hydrocarbons, MLPs have an economic relationship with oil prices, though as others have noted1 a significant portion of MLP cash flow is fee-based income, operating their businesses in a “toll-road” fashion, and not directly connected to the price of oil.2 Certainly the price of oil plays a role in pipeline demand, but it can be a complicated relationship. With all eyes on oil prices today, we look at two dynamics in the relationship to help determine how oil and MLP prices might interact in the near term.

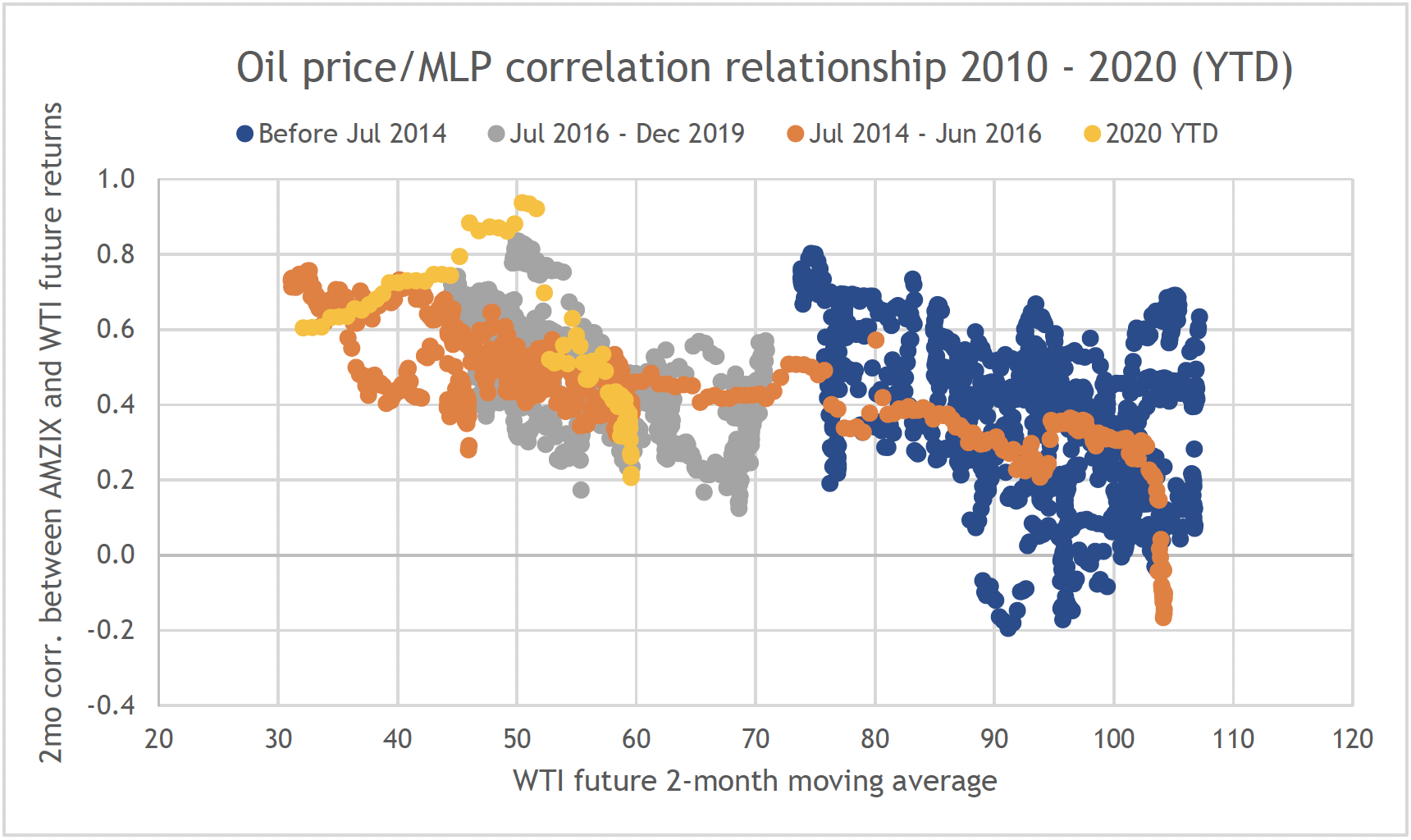

Dynamic 1: Correlation between MLPs and Oil is weak when the oil price is high but rises as the oil price drops to around the breakeven price3 for US oil producers.

1 Alerian “Insights at a Glance,” March 2020: https://tinyurl.com/vx5z332

2 CNBC, “Alternative Investing: How to master the tricks of energy investing”: https://tinyurl.com/yd9pelet

3 Dallas Fed Energy Survey, March 2020: https://tinyurl.com/yavucr87

The chart above graphs the two-month rolling correlation between MLPs (AMZI) and oil (WTI Futures) against the average oil price for that period. Four distinct time periods, noted with different colors, clearly show that as the oil price moves down, the correlation tends to go up, and vice versa. One theory for this relationship is that oil prices and MLPs have higher correlations as the oil price approaches production breakeven prices, which have declined over time4, because producers may reduce output near or below breakeven price, reducing demand for MLP pipeline capacity. The yearto-date 2020 period, shown in gold dots, is interesting, with a spike in correlation around the current breakeven price, but a decline in correlation as prices fell further. One potential reason for this relationship: MLP owners may be considering other business factors - such as balance sheet strength or product mix - more heavily in their assessment of MLPs.

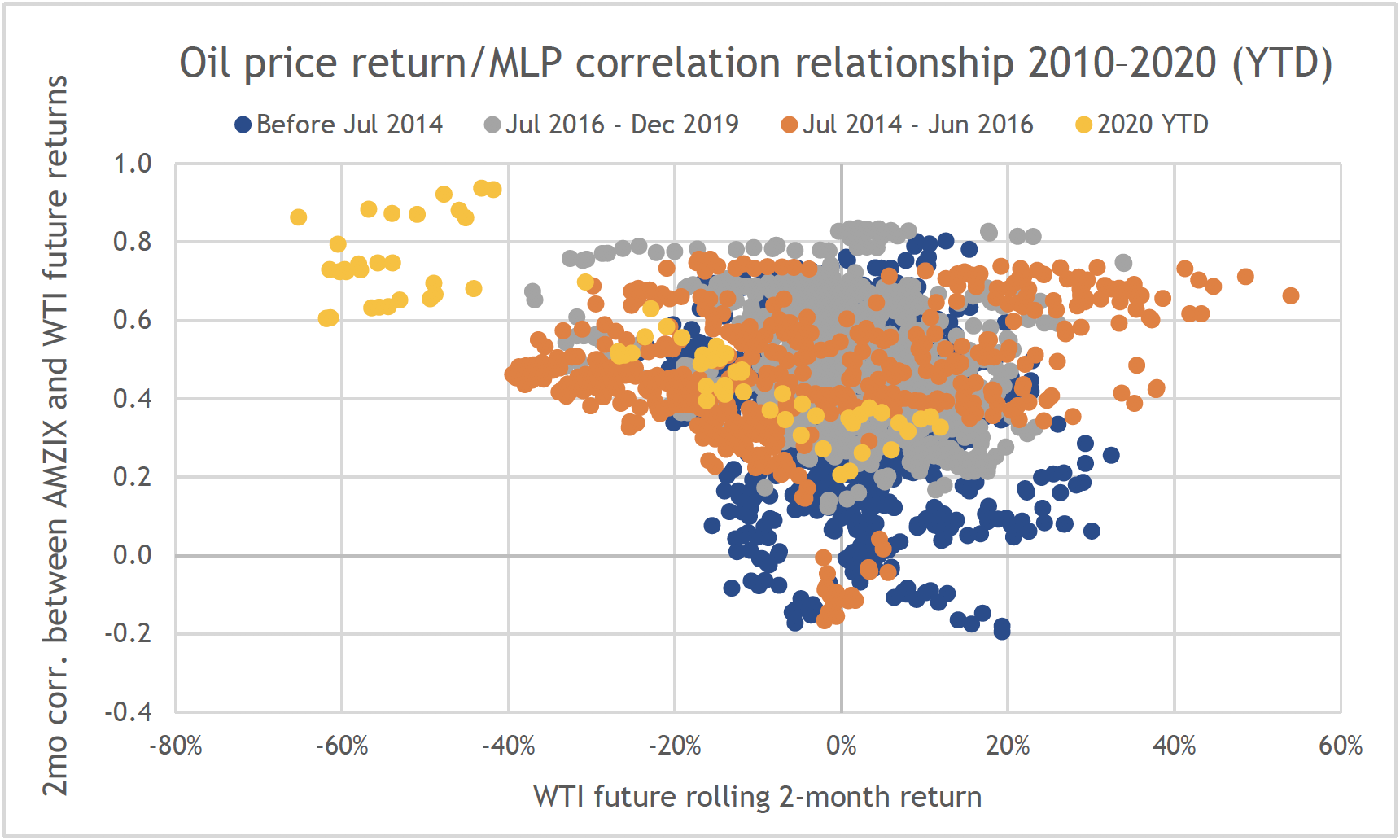

Dynamic 2: Correlation between MLPs and Oil spikes when there is a major change in oil prices

4 Federal Reserve Bank of Dallas, “Breakeven Oil Prices Underscore Shale’s Impact on the Market,” May 2019: https://tinyurl.com/yyn2zw94

This chart is similar to the prior, except the oil price level is now the oil price percent change. It appears that most of the time, for most changes in the price of oil, the correlation between MLPs and oil almost randomly fluctuates between 0 and 0.8, with the relationship probably better explained by the prior chart: the price level matters more than the price move, along with other dynamics. However, extreme oil price changes, like we have recently seen, have coincided with a very high correlation between MLPs and Oil – note the gold “year-to-date” dots in the upper left of the chart.

The Near-term Environment

MLPs and oil price have a complicated relationship, where the price level of oil relative to break-even production prices, and the price change of oil, exert varying pulls on MLPs at different times. With oil currently below most breakeven estimates, and trading within a relatively tighter price and percentage range, we believe that - absent additional dramatic swings - other factors, such as industry fundamentals, pipeline and storage utilization, and customer demand, and/or investor rebalancing and portfolio activity, could prove more important to near-term MLP returns. Also critical will be rising investor confidence in the potential for an economic recovery, and hence fuel volumes, which in the current environment we believe to be much more important for MLP returns than any relationship that MLP’s may have with short term oil price moves.

Disclosure: The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or to participate in any trading strategy, nor do the opinions expressed represent financial or investment advice. Opinions expressed in this document are subject to change without notice and do not represent a guarantee. If any offer of securities is made, it will be pursuant to a definitive offering memorandum prepared by Liberty Cove that contains material information not contained herein and which supersedes this information in its entirety. Any decision to invest in the strategy or fund managed by Liberty Cove should be made after reviewing such definitive offering memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. An investment in Liberty Cove’s strategy involves significant risks, including loss of the entire investment.