Assessing Master Limited Partnerships With Risk-Adjusted Yield

Master Limited Partnerships (MLPs) can offer attractive yields versus many other income-oriented instruments such as REITs, Utility stocks, and Bonds. In this edition of Liberty Cove’s Insight Series, we explore MLP yield and the effect of various investment portfolio approaches on MLP yield.

The MLP Yield Advantage Over Midstream C-Corps

As described in a recent Alerian post, Decisions, Decisions: Demystifying MLP Investment Options, June 6, 2020, MLPs tend to offer higher yields than midstream C-Corps due to their lack of entity-level (corporate) taxation. As evidence of this, Alerian points to the yield difference between the Alerian MLP Infrastructure Index (AMZI), which consists of only MLPs, and the Alerian Midstream Energy Select Index (AMEI), which limits MLPs to 25%. As of May 29, 2020, the AMZI’s yield was 10.7% compared to 7.9% for the AMEI, and for the last five years, the AMZI has had an average yield advantage of 224 basis points over the AMEI. This distinction can be of particular importance to those seeking yield as an investment priority.

Risk-Adjusted Yield

Despite the V-shaped recovery of many equity markets, including MLPs, the severity of the downturn earlier this year has caused many investors to examine the degree of volatility they are willing to accept in exchange for higher levels of yield.

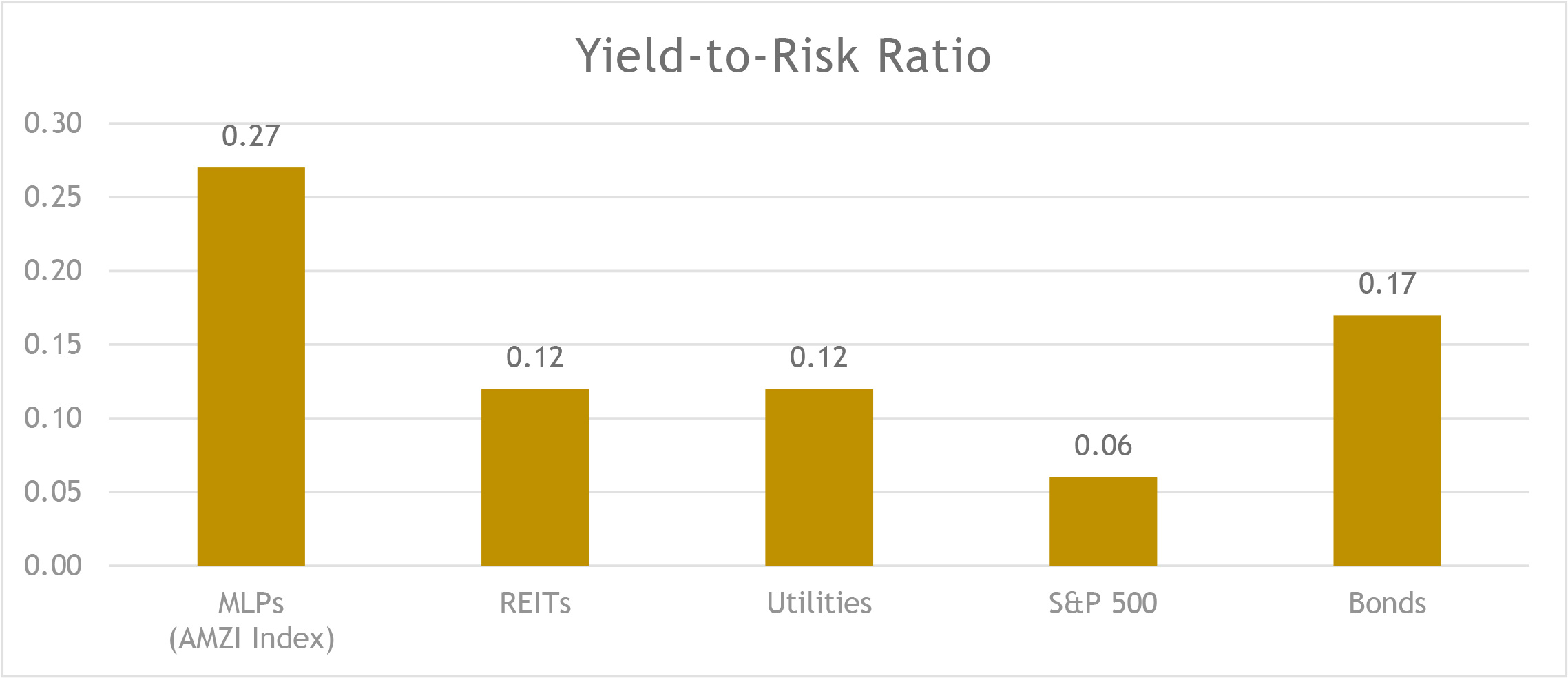

It may be helpful to compare the yields of various securities in the context of volatility by examining the yield-to-risk ratio. We define the yield-to-risk ratio as the current yield of the asset class minus the “credit-risk-free” current yield on treasuries, (in this case we use the 10-year treasury yield) divided by three-year annualized volatility, based on daily observations. The resulting number is essentially the current yield per unit of risk, thus allowing “like-for-like” yield comparisons across asset classes with different levels of volatility.

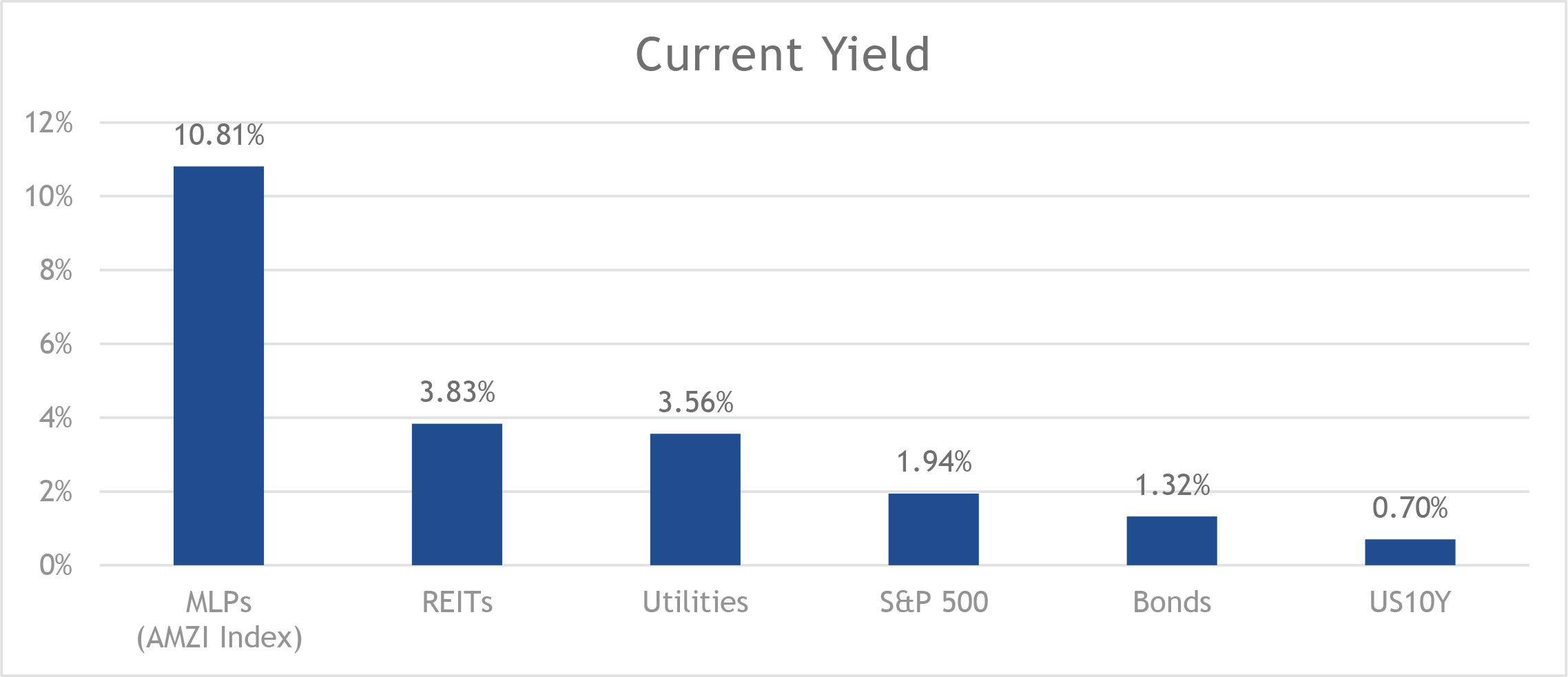

As the chart below shows, MLPs as a group yield nearly 11%, versus around 4% for other “yield- oriented” sectors like utilities and REITs, and less still for equities and bonds broadly, as of June 12, 2020.

MLPs are represented by the Alerian AMZI Index, REITs are represented by the FTSE NAREIT Real Estate 50 Index, Utilities are represented by the S&P 500 Utilities Index, Bonds are represented by the Barclays US Aggregate Total Return Index. Data as of 6/12/20.

However, some investors may note that MLPs have been more volatile than these other asset classes, exhibiting 1.5 to 1.7 times the volatility of the S&P 500, REITs and Utilities over the past three years. Assuming this risk relationship holds, and relative yield levels are maintained, MLP investors may be compensated for higher risk as they have a notable yield-to-risk premium, as shown in the chart below.

MLPs are represented by the Alerian AMZI Index, REITs are represented by the FTSE NAREIT Real Estate 50 Index, Utilities are represented by the S&P 500 Utilities Index, Bonds are represented by the Barclays US Aggregate Total Return Index. Data as of 6/12/20.

MLP yields can be viewed as attractive on both an absolute basis and adjusted for their higher risk, relative to other yield-oriented asset classes.

A Key Distinction: C-Corps Funds Versus Regulated Investment Companies

It is important for investors to carefully consider how they access MLPs. Mutual funds and ETFs that hold more than 25% in MLPs are themselves generally classified as C-Corps and therefore subject to taxation at the fund level. This can result in a deleterious “double taxation/tax drag.”

However, funds that maintain “registered investment company” (RIC) status by keeping their MLP exposure below 25% may be giving up some of the MLP yield advantage cited earlier, as illustrated in the chart below.

| Fund Structure: RIC | Fund Structure: C-Corps | |

|---|---|---|

| Hybrid portfolios holding MLPs and Midstream C-Corps instruments | Fund holds max 25% MLPs, so may offer lower yield than “All-MLP funds” | Likely lower yield and tax drag |

| “All-MLP” funds; exposure to MLPs exclusively | Optimal portfolio, potential for higher yield and lower tax drag | Without RIC status Fund may experience tax drag. |

An optimal MLP portfolio would offer broad exposure to MLPs while retaining RIC status

A potential solution to the tradeoff between higher yields and the tax advantage of RIC funds exists through a portfolio approach that combines direct MLP investments with securities designed to replicate the returns of major MLP indices, such as total return swaps. Using such an approach, investors can potentially gain broad access to the returns and yield of the MLP market through a portfolio that retains its RIC status for tax purposes.

A recent innovation by Liberty Cove Investors, trueMLP, can provide this solution. For more information about the firm and the trueMLP approach, visit our website.

Disclosure: The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or to participate in any trading strategy, nor do the opinions expressed represent financial or investment advice. Opinions expressed in this document are subject to change without notice and do not represent a guarantee. If any offer of securities is made, it will be pursuant to a definitive offering memorandum prepared by Liberty Cove that contains material information not contained herein and which supersedes this information in its entirety. Any decision to invest in the strategy or fund managed by Liberty Cove should be made after reviewing such definitive offering memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. An investment in Liberty Cove’s strategy involves significant risks, including loss of the entire investment.