Total Return Swaps: What Do Investors Need to Know?

Ever since the 2007–2008 financial crisis, many investors have become wary of using derivative contracts of any kind. With Collateralized Debt Obligations (CDO’s) at the technical heart of the mortgage meltdown and subsequent financial panic, all but institutional investors have shied away from using these financial tools and have become skeptical of investment products that use them. This short piece provides some background on Total Return Swaps and how Liberty Cove Investors uses them to achieve the desired asset class exposures in our portfolios, without taking undue risk.

What is a Total Return Swap?

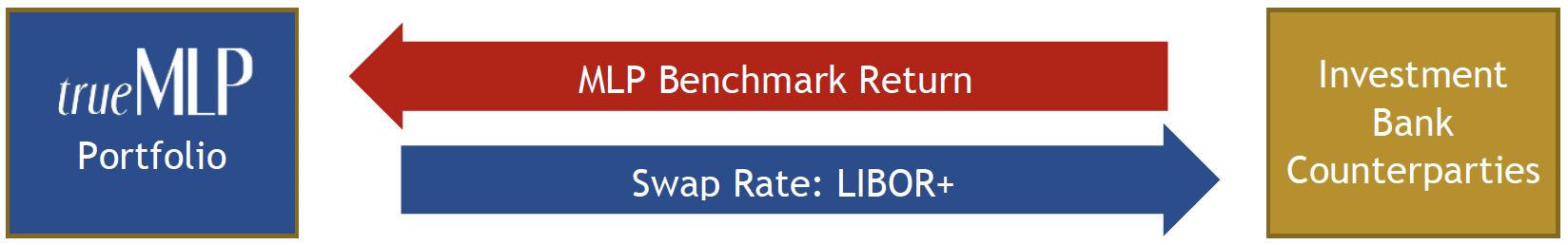

A total return swap is a contract between a “receiver” of the total return of the underlying asset and the “payer”, usually an investment bank. Liberty Cove makes extensive use of total return swaps on the Alerian MLP Infrastructure Index (AMZIX) in our management of the trueMLP Strategy. In our use of total return swaps, LCI (the receiver) makes an agreement with an investment bank (the payer), say JP Morgan or Bank of America, to pay the bank a small fee, typically benchmarked to LIBOR, e.g., 1-month LIBOR + 45 bps. In exchange, the banks agree to pay LCI the total return on the AMZI Index. The length of these contracts can vary, but one can trade out of them on a daily basis, just as easily as one can trade the underlying equities composing the index. The contracts can be renegotiated at will if market conditions change. Total return swaps allow LCI to pursue full exposure to an MLP Index, while still holding the bulk of the portfolio’s assets in cash.

What are the risks associated with Total Return Swaps?

MARKET RISK

Total Return Swaps carry the same exposure to underlying market movements as the underlying index. That’s the purpose of holding them!

COUNTERPARTY RISK

Unlike many other derivatives, such as exchange-traded notes, which expose investors to principal counterparty risk, the counterparty risk of total return swaps is limited to unrealized profit-and-loss (P&L) because no cash is exchanged initially. However, both parties to a total return swap may be subject to the risk that either party will be unable to fulfill their contractual obligations under the contract. It is important for the strategy to have sufficient liquidity so that it can make its interest payments under adverse market conditions. On the other hand, it is important that the paying bank has sufficient capital adequacy to continue to own the underlying asset backing the total return swap.

Total return swaps are typically settled monthly. However, whenever the unrealized P&L on the contract exceeds a certain threshold, say $50,000, cash is exchanged either as “variation margin” to collateralize the amount due, or to settle the amount due and reset the contract to zero. Thus, the counterparty risk is limited to either the threshold amount ($50,000 in this example) or one day’s P&L.

For example: Suppose LCI entered into a swap on the AMZIX Index with a notional amount of $1 million and a threshold of $50k. If the index movements created a 5% ($50k) unrealized profit for LCI, then the bank would send $50k to LCI, reducing LCI’s counterparty risk back to 0. If the next day’s index movement created a $25k profit for LCI, then no cash would be exchanged, and LCI’s counterparty risk would be $25k, i.e. the risk that the bank counterparty would be unable to pay the $25k to LCI at the month-end settlement. In the case of an index decline this process works in reverse, with funds flowing from LCI to the investment bank. Importantly, these day-to-day movements are much smaller than the notional amount ($1 million) of the contract.

FLOATING INTEREST RATE RISK

Both parties to a total return swap may be subject to floating interest rate risk. The interest rate is typically reset monthly. When these resets occur, an increase in interest rates will increase the size of the payments the receiver must make to the payer while a decrease in rates reduces the payments to the payer.

In summary, total return swaps can play a valuable role in portfolio management when investing in securities such as MLPs.

Disclosure: The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or to participate in any trading strategy. If any offer of securities is made, it will be pursuant to a definitive offering memorandum prepared by Liberty Cove that contains material information not contained herein and which supersedes this information in its entirety. Any decision to invest in the strategy or fund managed by Liberty Cove should be made after reviewing such definitive offering memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. An investment in Liberty Cove’s strategy involves significant risks, including loss of the entire investment. The terms of the total return swaps shown in this document, including but limited to interest rates and thresholds, are for illustrative purposes only and may differ from actual contract terms.