The Power of Pure: Midstream Master Limited Partnerships vs. C-Corps

- MLPs have historically offered a significant yield advantage over other income-oriented securities.

- Midstream MLPs may offer a yield advantage over midstream C-corps.

- Investors seeking “pure” MLP exposure - not blended with C-Corps - may want to consider funds that are both "All-MLP" and retain RIC status to avoid corporate tax drags.

In this paper, we examine the benefits of using an “all-MLP” approach when investing in midstream energy companies via mutual funds and ETFs, and we describe an innovative new approach designed to provide full, tax-efficient and low-cost MLP exposure.

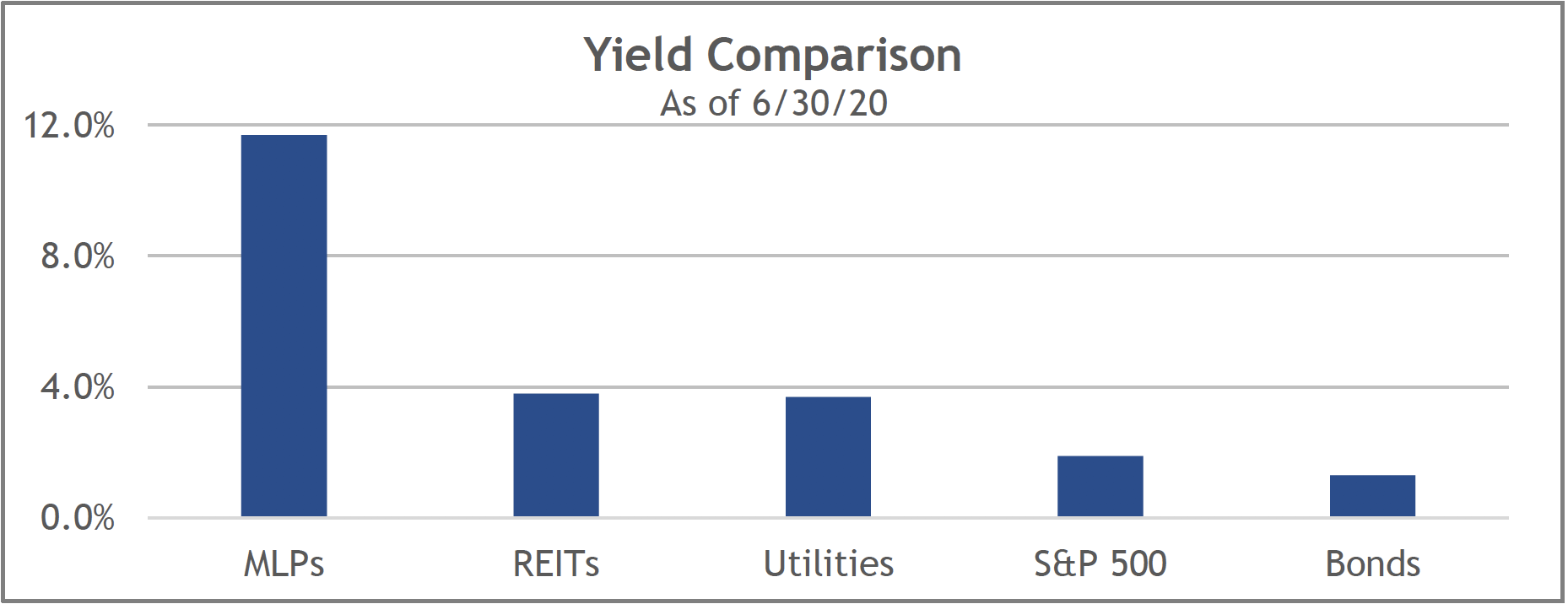

First, a quick review of the benefits of investing in master limited partnerships. MLPs have historically offered a significant yield advantage over other income-oriented securities such as REITs, utility stocks, and government bonds, as shown in the chart below. (Note that this relationship holds true on a volatility-adjusted basis as well, as we have shown in our previous MLP Insight paper, Assessing Master Limited Partnerships With Risk-Adjusted Yield)

Past performance is not indicative of future results. One cannot invest directly in an index. MLPs are represented by the Alerian AMZI Index, REITS are represented by the FTSE NAREIT Real Estate Index, Utilities are represented by the S&P 500 Utilities Index, Bonds are represented by the Barclays US Aggregate Total Return Index.

Further, MLPs have robust, fee-based “toll-road” business models, which can help insulate them from sharp moves in commodities prices and reduce their correlation to oil prices. Finally, by holding MLPs, investors can participate in the continuing US energy “renaissance,” which has generated historically high levels of crude oil and natural gas production in recent years. Energy sector growth is expected to continue in the long-term, despite the current economic disruption caused by the Covid-19 pandemic.

Why We Prefer the MLP Structure for Midstream Energy Company Investment

While a significant portion of the midstream energy sector is composed of companies organized as master limited partnerships, many others are organized as C-corporations—an important distinction. A recent post by MLP index provider Alerian described a yield advantage offered by midstream MLPs vs. their C-corps brethren. As evidence of this, Alerian points to the yield difference between the Alerian MLP Infrastructure Index (AMZI), which consists of only MLPs, and the Alerian Midstream Energy Select Index (AMEI), which limits MLPs to 25%. A recent comparison showed AMZI’s yield to be 10.7% compared to 7.9% for the AMEI. Longer term, the AMZI has had an average yield advantage of 224 basis points over the AMEI (for the five years ended May 2020). This distinction can be of importance to those seeking yield as an investment priority.

The “Pure” vs. Hybrid Dilemma

Having made the decision to own a portfolio fully composed of MLPs, mutual fund and ETF investors face a dilemma because funds that seek to maintain their status as Regulated Investment Companies (RICs) for tax purposes are required to limit their holdings in MLPs to less than 25%, while funds that offer “full” exposure to MLPs are organized as C-corps, and are therefore subject to federal corporate tax. This tax drag can negatively affect the total return and yield of such funds. Another consideration that yield-oriented investors in particular may want to consider: RICs - or “hybrid” – portfolios may hold significant positions in relatively lower-yielding securities, such as REITs and utilities stocks.

Why Take a “Pure” Approach to MLP Allocations?

As a rule, asset allocation models are composed of various “building blocks” that offer undiluted exposure to the asset classes and security types being sought. Only in this way can allocation decisions be properly monitored and measured. Given the yield advantage of midstream MLPs versus C-corps described earlier, this is an important consideration for investors using passive funds and ETFs to implement optimal portfolio allocations. Asset allocators must also avoid unintentional duplication in their portfolios: MLPs are not included in broad equity indexes, while C-corps midstream companies may be, highlighting the value of “pure” MLP funds as completion portfolios - allocating to securities that are not already represented in the portfolio.

Master Limited Partnerships - Insight Series No. 6, September 2020 3

Using Care When Selecting an MLP Strategy

We believe that fund investors seeking MLP exposure as part of their overall portfolio allocations are well-served by approaches that provide full – or “pure”—exposure, not blended exposure. Therefore, investors must be mindful of the 25% limitation on MLPs typically imposed on funds that seek to preserve their status as Regulated Investment Companies (RICs), which are not taxable at the company level. Instead, investors seeking MLP exposure through 40-Act products such as mutual funds and ETFs may wish to seek optimal portfolios that can be both fully invested in MLPs and structured as Regulated Investment Companies—a strategy that has been unavailable until recently.

| Fund Structure: C-Corps | Fund Structure: RIC | |

|---|---|---|

| “All-MLP” funds; exposure to MLPs exclusively | Without RIC status Fund may experience tax drag. | Optimal portfolio, potential for higher yield and lower tax drag |

| Hybrid portfolios holding MLPs and Midstream C-corps instruments | Likely lower yield and tax drag | Fund holds max 25% MLPs, so may offer lower yield than “All-MLP funds” |

A unique innovation by Liberty Cove Investors, trueMLP, can solve the dilemma of the tradeoff between “pure” MLP exposure and portfolios that are able to maintain RIC legal status only by keeping MLP exposure below 25%. The trueMLP approach combines direct MLP investments with securities that are designed to replicate the returns of major MLP indices, such as total return swaps. Using such an approach, investors can potentially gain broad access to the returns and yield of the MLP market through a portfolio that retains its RIC status for tax purposes.

Disclosure: The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or to participate in any trading strategy, nor do the opinions expressed represent financial or investment advice. Opinions expressed in this document are subject to change without notice and do not represent a guarantee. If any offer of securities is made, it will be pursuant to a definitive offering memorandum prepared by Liberty Cove that contains material information not contained herein and which supersedes this information in its entirety. Any decision to invest in the strategy or fund managed by Liberty Cove should be made after reviewing such definitive offering memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. An investment in Liberty Cove’s strategy involves significant risks, including loss of the entire investment.